Pet Insurance – Help or Hype?

By Robert Piehl Working collie Daisy with broken radius and ulna. Repairing her leg ended up taking three surgeries. How would pet insurance have helped the owners with the costs?

For the purposes of this brief report on Pet Insurance, I’ve looked at the programs offered by ASPCA Pet Health Insurance, 24 PetWatch QuickCare, VPI and Trupanion. The first three companies control close to 90% of the pet insurance market while Trupanion is a newcomer.

In a survey by the Associated Press and Petside, the majority of pet owners tend to set the limit at $500 for pet medical expenses and as the costs rise, the number of pet owners willing/able to pay goes down rapidly. In 2010 it was estimated that 3% of dogs and 1% of cats were covered by some type of pet insurance to help with medical and surgical expenses. The premiums for these policies range from just under $10 to over $90 per month. These premiums vary by where you live, your pet’s breed and age, the deductible you’ve chosen and the type and extent of coverage selected. I was not able to find a figure for the number of pets that undergo “economic euthanasia” do to the owner’s inability to pay veterinary costs.

The purveyors of pet insurance focus on both your pocket and your love for your pet in their advertising. These policies require careful scrutiny before purchase. All of them have numerous limits and exclusions. They all have deductibles, co-pays or both. Some have “maximums” for individual illnesses. As an example, one company excludes medical care for Shar Peis and mixes of that breed though accidents are covered. Some do not cover hip dysplasia. Preexisting conditions are not covered and an existing condition may be excluded when you renew your policy. All of the companies have rather extensive lists of excluded conditions. Study these lists carefully, know your breed health probabilities and carefully assess your aversion to risk. In the case of a medical condition that becomes long-term or chronic, one insurer, ASPCA Pet Health Insurance offers “continuing care” in the renewal policy … with a 30+% increase in the premium.

Consumer Reports performed an in-depth comparison of the four companies mentioned at the beginning and 9 of their plans. For the study, the medical history of a pure bred Beagle over a 10 year period was used. All costs were converted into today’s dollars. The beagle was basically healthy.

During her lifetime, costs were incurred for:

Annual check-up, inoculations and preventives.

Two emergency visits for ingestion of chocolate

Puncture wound treatment after a fight

Two dentals under general anesthesia

A few eye and ear infections

To further compare the plans, some expensive hypothetical ailments were added and coverages compared.

Chronic arthritis

Incontinence as a result of spaying

Hypothyroidism

Removal of a benign tumor

Euthanasia

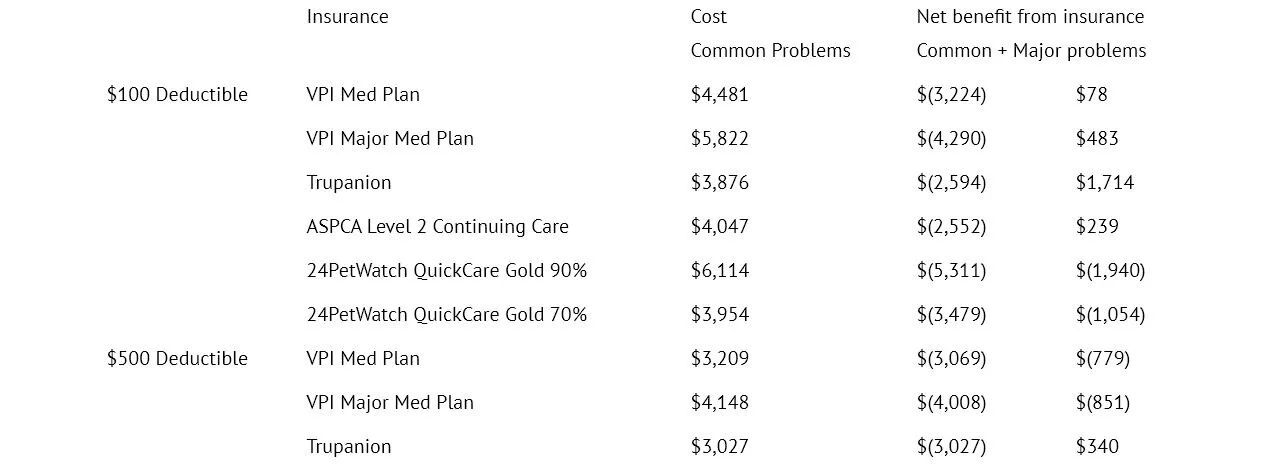

Below is a table comparing different plan coverages for the beagle’s common problem history and with the added hypothetical serious issues. Note the payouts in the Net Benefits columns.

(numbers in parenthesis represent the portion of the bill that the pet owner pays)

Resources for more information:

www.trupanion.com (Trupanion insurance)

www.petinsurance.com (VPI insurance)

www.aspcapetinsurance.com (ASPCA insurance)

www.24petwatch.com/petinsurance (24PetWatch)

Have you had experience with pet insurance that you would be interested in sharing? Please send any comments to marketing@almosthomeohio.org.

According to the American Pet Products Association, the average dog owner spent $225. on routine vet visits and $532 on surgical visits. Adding these amounts and comparing them to the table of premium costs above, the case appears to be made for self-insuring—saving a set amount each year in an account for pet emergencies rather than paying the premiums that generally cost significantly more than the veterinary expenses most of us will incur.

If you suffer the misfortune of having a dog with a chronic condition or illness or a young animal that needs major veterinary care, you may experience a positive payout from pet insurance coverage. Most of us, however, will pay significantly more in premiums than we will receive for covered expenses.

Should you need the security of insurance coverage for your pet(s), it is very important that you carefully study the plans available, paying particular attention to the lists of excluded conditions, deductibles, co-pays, maximums, coverage for chronic conditions and coverage limits.

(Note that ADHRO does not endorse or recommend any specific pet insurance policies.)